This is in line with its focus on tackling the issue of missing revenue from the shadow economy. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

Ambertax Usa Tax Refund For J 1 H 2b And Other Temporary Visitors

Time limit for Customs Approval.

. Our calculation assumes your salary is the same for 2020 and 2021. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Is this an approved tax free shop.

The IRB is allowed to issue an additional assessment if it thinks that the original assessment is not sufficient. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. How to maximise your income tax refund Malaysia 2019 YA 2018.

030 Malaysian ringgits MYR per litre is applicable. Remember claiming for tax reliefs and the like are the key to maximising your tax refund for the year so start listing. There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000.

First-time homebuyers will have stamp duty exemption for homes between RM300000 to. Whether youre single married or have children there are tax reliefs to help maximise your tax refund. KUALA LUMPUR March 11 No-one likes seeing a chunk of their hard-earned salary being deducted for tax purposes.

Have not received your Tax Refund. Tax rebate for self. The Goods and Services Tax GST and Income Tax refunds.

Personal income tax rates. Taxes for Year of Assessment 2021 should be filed by 30 April 2022. It incorporates key proposals from the 2020 Malaysian Budget.

The IRBM Clients Charter sets that tax refund will be processed within 30 working days after e-Filing submission. You have to spend at minimum 300 MYR inclusive of GST equivalent to 70 USD in order to be eligible for tax refund. How to claim Tax Refund in Malaysia a step by step instruction.

Your tax refund if any will be returned to the bank account number provided. As at 31 May 2018 the total tax refunds owing amounted to RM354 billion made up of GST refunds of RM194 billion and income tax refunds of RM16 billion. Starting from Year of Assessment 2013 any taxpayers who do not receive their refund from LHDN within the 30 days will.

The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020. Year-end roundup 2019.

Within 90 working days after manual submission. The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019.

Such assessment can only be issued within 5 years or 7 years for transfer pricing issue from the end of that particular. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. State Your Income.

Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. 20192020 Malaysian Tax Booklet. RinggitPlus compares and help you apply credit cards personal loans and housing loansFind the best mortgage deal on your dream house or apartment or simply discover great.

Now that you know about all the income tax reliefs rebates and deductions that are available for Malaysia personal income tax 2020 YA 2019 make sure to get your tax filing in order so you dont miss out on any claims. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. 3 months from the day of purchase.

Unlike the debts accruing to 1MDB and. For 2019 the government is estimated to collect RM1899 billion in taxes. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Disposal of asset under the Real Property Gains Tax Act 1976 will be relevant to you if youve sold any property in the last year. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Monday 16 Dec 2019 1007 AM MYT.

Follow us on Instagram subscribe to our Telegram channel and browser alerts for the latest news you need to know. Tax rebate for self. Tax revenue remains a catch-up game for boosting govt coffers.

Malaysian tax enforcement in 2020 - Updates. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Tax Relief Year 2019.

The procedure however is subject to information given in ITRF as well as the submission of supporting documents if required for review. If youre earning above RM34000 per annum youre not going to escape paying your taxes but what you can do is make sure you get the maximum possible tax refund back. A tax return submitted by the prescribed due date is deemed to be an assessment made on the taxpayer on the date of submission.

If you are using income tax e-Filing to file your tax and you provide your bank account details correctly you will be getting your refund credited directly into their bank accounts within 30 days after the declaration is made. Tax rebate for. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing.

You can file your taxes on. These refunds belong to the taxpayers and were misused without their permission or knowledge. Following the recently concluded Special Voluntary Disclosure Program SVDP in September 2019 the IRB will increase its staff allocation for its enforcement activities from 60 to 80 in 2020.

Meanwhile for the B form resident. A specific Sales Tax rate eg. The amount of tax relief 2019 is determined according to governments graduated scale.

KUALA LUMPUR Dec. Here are some tax reliefs you can claim when filing your income tax for YA 2018.

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Where To Go With Your Tax Refund In 2019 Going Off The Grid Where To Go Island Resort

Why Tax Refunds Are Taking Longer Than Usual

Tax Refund Timeline Here S When To Expect Yours

Tax Refund Timeline Here S When To Expect Yours

Vat Refund Rate In Europe Bragmybag

Thailand Integrates Blockchain To E Visa System For Higher Security Blockchain Commercial Bank Tax Refund

Guide To Tax Refund In Japan Bragmybag

Tax Refund Timeline Here S When To Expect Yours

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Don T Normally File A Tax Return You May Be Due A Credit A Refund Nonetheless

Average Tax Refund Up 11 In 2021

Guide To Tax Refund In Switzerland Bragmybag

Four Reasons Why Your Tax Refund May Be Delayed In 2022

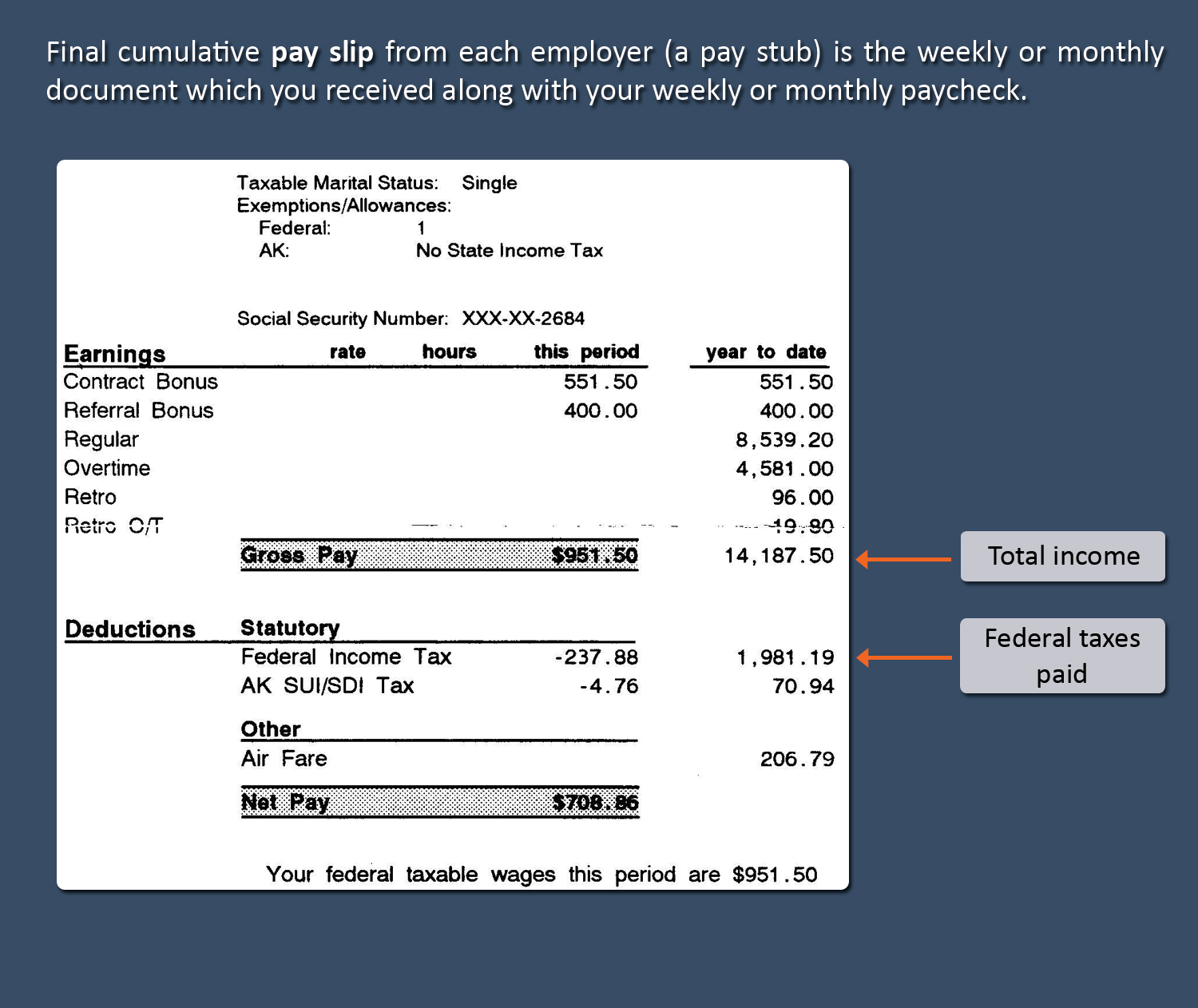

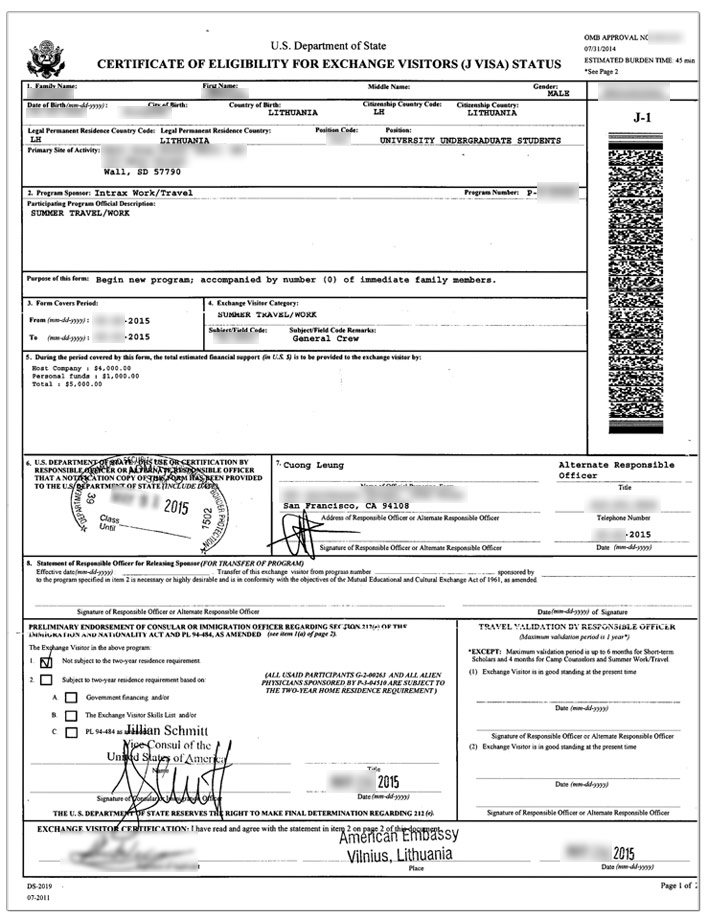

Quick Tax Refund If You Worked In The Us Rt Tax

Guide To Tax Refund In Malaysia Bragmybag